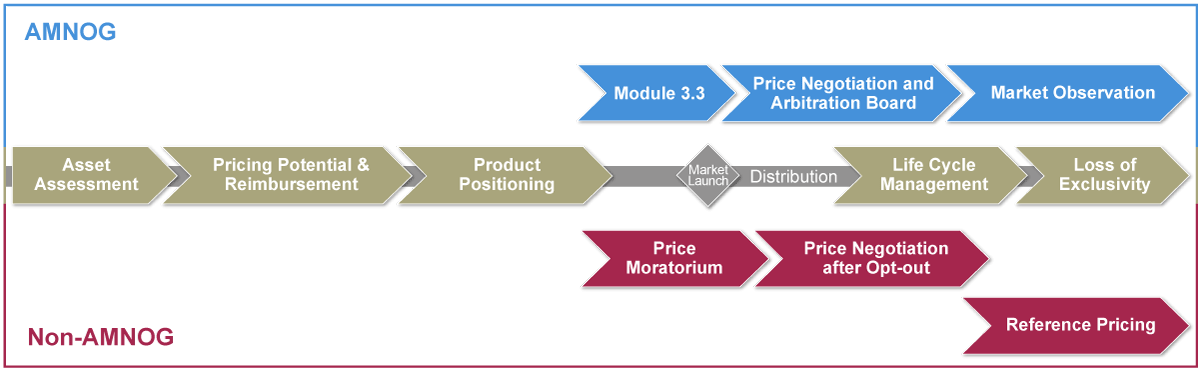

From the economic development of entire therapeutic areas to the active negotiation of a reimbursement price to the loss of market exclusivity: The E+E Pricing Core Model® provides an overview of the navigatable service modules:

From the economic development of entire therapeutic areas to the active negotiation of a reimbursement price to the loss of market exclusivity: The E+E Pricing Core Model® provides an overview of the service modules:

Asset Assessment

In the early development phase, the economic potential of a medicinal product is difficult to anticipate. The same applies to additional purchases or the licensing of potential medicinal product candidates. What is the development trend of therapeutic areas medically and thus also economically?

Methodology

- Comprehensive horizon scanning of the therapeutic landscape

- Update of medical guidelines and therapeutic need

- Anticipation of price trends (e.g. after patent loss)

Services

- Market analyses (simulation of indications and/or therapeutic areas)

- Portfolio analyses (analysis of effects on the portfolio)

Pricing Potential & Reimbursement

For innovative medicinal products, the most important parameters for the later price negotiation are often determined already before the marketing authorization. Which potentials arise from the current parameters for the resulting reimbursement level and which strategic levers should be taken into account at an early stage?

At the same time, the much more fundamental question for new treatment methods and medical devices is coming up as to whether they are reimbursable in Germany at all, and which procedural steps would be required.

Methodology

- Derivation of potential AMNOG scenarios

- Identification of analog- and reference cases

- Simulation of price trends

- Application of rule as per § 87 German Social Code, Book V (SGB V)

- Application of rules as per § 135 and 137c SGB V

Services

- Evaluation of the potential of the reimbursement price

- Analysis of competition strategies

- Development of outpatient and inpatient reimbursement routes

- Support of NUB- and EBM applications

Product Positioning

The “real“ market entry of an innovative medicinal product determines the price level that can be achieved in the long run. In case of several indication areas, the order of marketing authorizations is as important as the market launch price. How should both parameters be chosen in order to generate a high excess value? Which specific contract models are conceivable to provide a steady support to the medicinal product?

Methodology

- Derivation of potential AMNOG scenarios

- Identification of analog market prices

- Simulation of price trends

- Application of the rule as per § 83 SGB V

- Application of the rules as per § 73b, 73c, and 140a SGB V

Services

- Development and assessment of potential launch sequences

- Analysis of the launch price level

- Evaluation of collective and selective contract models

- Development of innovative contracts

- Support of implementation

Life Cycle Management

Life Cycle Management is an essential process in the pricing of pharmaceuticals. It comprises various strategies and measures to optimize the economic value of a medicinal product throughout the entire product life cycle. Apart from securing initial exclusivity rights such as patent protection and data exclusivity, market entry not only requires considerations regarding the launch price, but also an overview of the pricing strategy for the entire product life cycle and the optimization of the product price during these phases.

Methodology

- Analysis of the current market

- Identification of legal and economic leeway

- Anticipation of future legal changes to price and market dynamics

Services

- Development of sustainable price- and market positioning strategies

- Long-term price planning, also taking into account further product development

- Early assessment of future price regulations such as reference prices, rebate contracts, and pharmacy dispensing rules

- Presentation of options to optimize product development under pricing aspects

Loss of Exclusivity

The loss of market exclusivity and launch of generics or biosimilars quickly results in a drastic market disruption. Both the price level and the sales volume of the original collapse. Are pharmaceutical companies still able to generate relevant turnovers after the loss of exclusivity, and which strategy should be pursued?

Methodology

- Identification of suitable analog cases

- Analysis of prescription data

- Identification of prescription standards

Services

- Projection of erosion of price and sales volume

- Projection of reference prices

- Analysis and determination of potential of rebate contracts

Module 3.3

The section on health economy in the AMNOG dossier is one of the most important influencing factors for the later price negotiations with the GKV-SV. Which cost description in Module 3.3 best supports the value story and the price negotiation? Where is a potential for optimization?

Methodology

- Review of SmPC

- Calculation of annual therapy costs

- Processing of analog G-BA decisions

- Derivation of potential scenarios for the price negotiation

Services

- Development of the negotiation strategy

- Preparation of negotiation arguments that withstand the arbitration board

- Full preparation of Module 3.3

- Strategic review

- Quality assurance (mathematical and formal)

Price Negotiation and Arbitration Board

The decision of the Federal Joint Committee (G-BA) on the benefit assessment is immediately followed by the price negotiation with the National Association of Statutory Health Insurance Funds (GKV-SV). Apart from the outcome of the benefit assessment and legal and formal criteria, many other factors will have an impact on the price negotiation which cannot completely be controlled by the pharmaceutical manufacturers but have to be taken into account for their negotiation strategy. Which strategy should be pursued in the negotiation and which argumentation lines have to be prepared for this?

Methodology

- Critical analysis of base case

- Identification of strategic factors

- Transfer of experience from previous price negotiations

- Application of the rule and framework agreement as per § 130b SGB V

Services

- Strategy development

- Simulation of reimbursement price

- Preparation of negotation rounds

- Simulation of negotiation rounds

- Active participation in the negotiation

- Support of arbitration procedure

Early Benefit Assessment and AMNOG Price Negotiations

Market Observation

Fundamental market conditions may change already shortly after the successful completion of a price negotiation. A short contract term makes the situation even more critical. Which central influencing factors have changed since the price negotiation, and which impact do they have on the continuation of the reimbursement price agreement?

Methodology

- Determination of the market situation

- Identification of relevant changes

- Anticipation of the GKV-SV‘s intention to terminate the contract

Services

- Analysis of the termination risk

- Systematic monitoring of market parameters

Price Moratorium

For medicinal products in Germany with known active ingredients, there are various effective mechanisms of price regulation. Is the medicinal product subject to the price moratorium? How can pricing be performed under the price moratorium? Is an exemption possible?

Methodology

- Application of the rule as per § 130a SGB V

- Implementation of the guideline for manufacturer rebates (GKV-SV)

Services

- Review of the applicability of the price moratorium

- Application for exemption from the price moratorium

- Calculation of inflationary compensation

- Determination of manufacturer rebates

Price Negotiation after Opt-out

Since the coming into effect of the SHI Financial Stabilization Act (GKV-FinStG), medicinal products with known active substances have the possibility to opt out of the price moratorium. After a successful application, a reduced price negotiation with the GKV-SV will take place. What is the strategy to be pursued in the negotiation and which argumentation lines have to be prepared for this?

Methodology

- Identification of strategic levers

- Transfer of experience from previous price negotiations

- Application of the rule as per § 130a para 3c SGB V

- Implementation of the guideline for manufacturer rebates (GKV-SV)

Services

- Strategy development

- Full preparation of application

- Preparation of the negotiation round

- Active participation in the negotiation

Reference Pricing

Reference prices for medicinal products will become relevant with the loss of market exclusivity at the latest, but sometimes also earlier, if groups of patent-protected and patent-free active substances are formed. The reference price procedure follows defined rules. This allows to simulate reference prices in advance, to review calculations of the GKV-SV and to develop reimbursement strategies related to the reference price.

Methodology

- Analysis of the market situation

- Simulation of price changes

- Simulation of package changes

Services

- Forecast of reference price risk

- Review of group formations and proposed reference prices

- Support of hearing procedures

- E+E Reference Price Calculator and trainings on reference pricing

Asset Assessment

- How is the development of prices in the indication areas and which potential do they offer for the product in the future?

Pricing Potential & Reimbursement

- What could be potential reimbursement prices?

- Is the product basically reimburseable in Germany?

Product Positioning

- What is the recommended launch sequence in case of several indications?

Price Moratorium

- Is the price moratorium to be applied or are exceptions possible?

Price Negotiation after Opt-out

- Which strategy will be successful after exemption from the price moratorium?

Reference Pricing

-

What could be the potential reference price?

Module 3.3

- How can the AMNOG dossier best support the pricing strategy?

Price Negotiation and Arbitration Board

- Which price negotiation strategy leads to the best price?

Market Observation

- Which changes taking place in the market are relevant for pricing?

Life Cycle Management

- How can the price of a medicinal product be optimized throughout the product life cycle?

Loss of Exclusivity

- Which price and sales erosion has to be expected after LoE?

- What is the recommended pricing strategy?

Please contact

Janine Leismann

Phone +49 (40) 41 33 081-26

Nico Maaß

Phone +49 (40) 41 33 081-651